MILANO – In inglese, riportiamo il commento sulla situazione della borsa. Diamo quindi uno sguardo alle chiusure di New York e di Londra. Così da farsi un’idea dell’andamento del mercato, sempre un riflesso per la condizione del made in Italy.

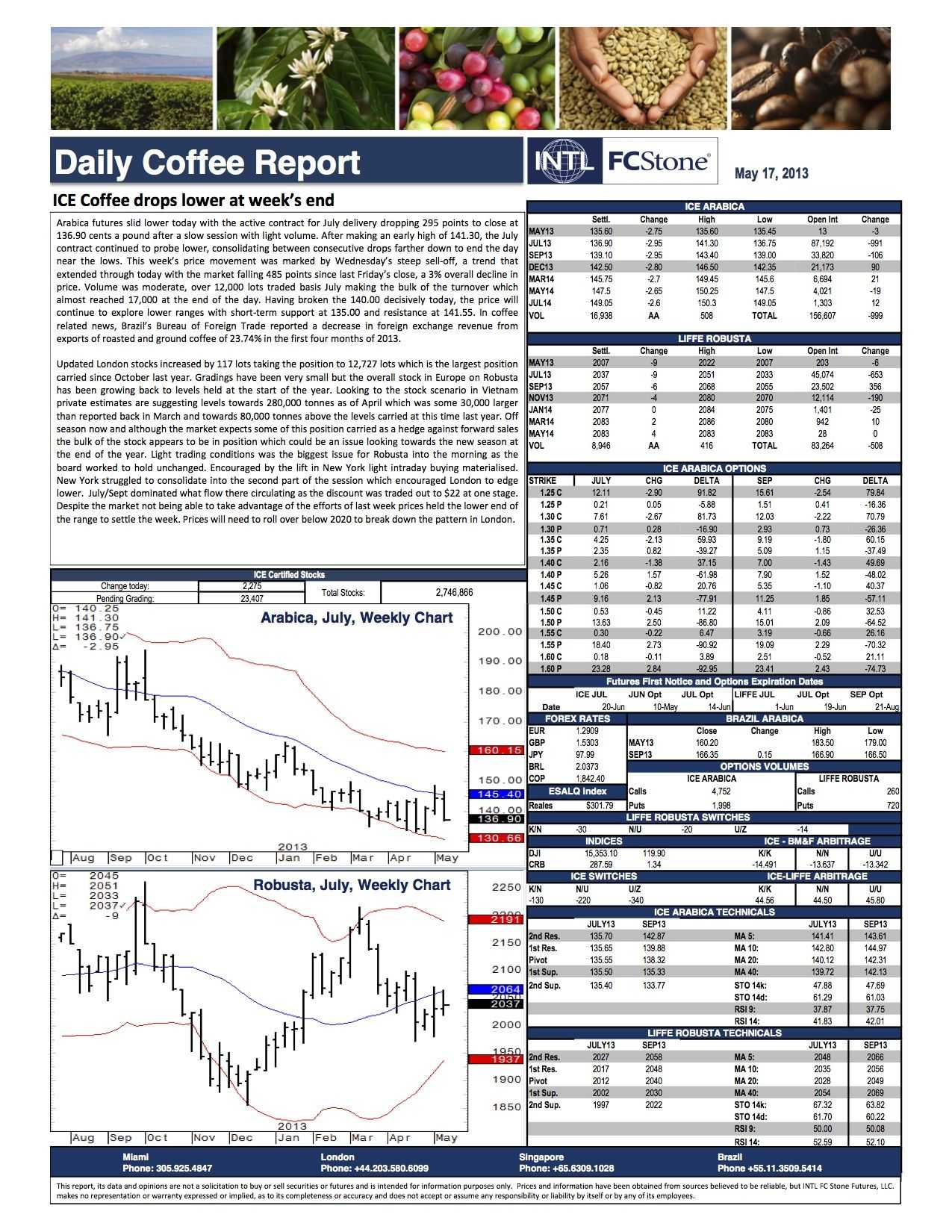

Arabica futures slid lower today; with the active contract for July delivery dropping 295 points to close at 136.90 cents a pound. After a slow session with light volume.

After making an early high of 141.30, the July contract continued to probe lower; consolidating between consecutive drops farther down to end the day near the lows.

Arabica futures news

This week’s price movement was marked by Wednesday’s steep sell-off. A trend that extended through today with the market falling 485 points since last Friday’s close; a 3% overall decline in price.

Volume was moderate

It was over 12,000 lots traded basis July making the bulk of the turnover. It almost reached 17,000 at the end of the day. Having broken the 140.00 decisively today, the price will continue to explore lower ranges;

with short-term support at 135.00 and resistance at 141.55. In coffee related news, Brazil’s Bureau of Foreign Trade reported a decrease in foreign exchange revenue from exports of roasted and ground coffee of 23.74%. That’s in the first four months of 2013.

Updated Arabica futures

Updated London stocks increased by 117 lots taking the position to 12,727 lots which is the largest position carried since October last year.

Gradings have been very small

But the overall stock in Europe on Robusta has been growing back to levels held at the start of the year. Looking at the stock scenario in Vietnam private estimates are suggesting levels towards 280,000 tonnes.

Exactly as of April which was some 30,000 larger than reported back in March and towards 80,000 tonnes above the levels carried at this time last year.

Offseason now and although the market expects some of this position carried as a hedge against forwarding sales the bulk of the stock appears to be in position. It could be an issue looking towards the new season at the end of the year.

Light trading conditions was the biggest issue for Robusta

In the morning, the board worked to hold unchanged. Encouraged by the lift in New York light intraday buying materialized. New York struggled to consolidate into the second part of the session. It encouraged London to edge lower.

July/Sept

This period dominated what flow there circulating as the discount was traded out to $22 at one stage. Despite the market not being able to take advantage of the efforts of last week.

Prices held the lower end of the range to settle the week. They will need to roll over below 2020 to break down the pattern in London.

I dettagli

Se poi siete appassionati di borsa, grafici e dati, Comunicaffè fornisce anche il materiale dettagliato.

E’ sufficiente consultare infatti il pdf che si apre al seguente link.